Results improve in the Second Quarter

In this article

The corporation announced better than expected news when it reported our second quarter 2021 earnings of $4.7 billion earlier this summer. Higher oil and gas demand and the best-ever quarterly performance in the Chemicals business helped turn around the results, which surpassed analyst forecasts.

The results compared favourably to the second quarter of 2020, which saw a loss of $1.1 billion due to a fall in demand for our products and the oil price crash at the height of the pandemic.

This year, second-quarter capital and exploration expenditures were $3.8 billion, bringing the first half of 2021 to $6.9 billion, which is consistent with planned lower activity in the first half of the year. Higher second-half spending is anticipated on key projects and in Chemicals, with full-year spending expected to be towards the lower end of the guidance range of $16 billion to $19 billion.

Our Low Carbon Solutions business is advancing multiple CCS opportunities and low-emission fuels initiatives, while portfolio improvement activities included signing an agreement for the projected $1.15 billion fourth-quarter sale of the SantopreneTM chemical business, including our operations in Newport.

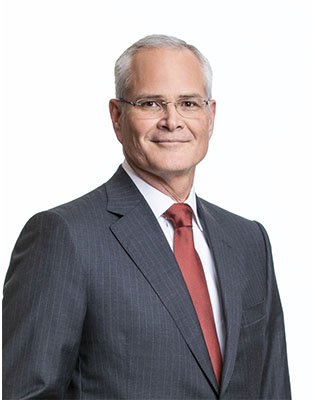

“Positive momentum continued during the second quarter across all of our businesses as the global economic recovery increased demand for our products,” said Darren Woods, chairman and chief executive officer.

“We’re realising significant benefits from an improved cost structure, solid operating performance and low-cost-of-supply investments that, together, are generating attractive returns and strong cash flow to fund our capital programme, pay the dividend and reduce debt.”

He added: “In our efforts to support society's energy transition goals, our Low Carbon Solutions business made progress in identifying new opportunities and in establishing new partnerships in carbon capture and storage, hydrogen and low-emission fuels.”

Fawley Brings the Bounce Back to Play Sessions

Affordable play sessions for children will have an extra bit of bounce after ExxonMobil Fawley made a £1,500 contribution towards the purchase of a new inflatable for Gang Warily Recreation Centre in Fawley.